![]() Looking at the latest indicators, we could not say that Masterplast must operate in an adverse economic environment. How long might this boom take?

Looking at the latest indicators, we could not say that Masterplast must operate in an adverse economic environment. How long might this boom take?

The economic environment is really supportive in our markets, including all the important markets in Central Eastern Europe and Western Europe, not just Hungary. Although, it is doubtful that an overall economic slow-down can be seen which is clearly measurable in the numbers of automobile and other manufacturing industry. It is also visible that the correlation that used to be typical in the construction industry, according to what the weakening of manufacturing history is always followed by a constructional downturn within months is not valid, and as the analysts see, these trends have separated. The manufacturing industry, including all the companies interested in it, will probably slow down in the following period while the consumption and income level are expected to grow, and the pace of salary growth might slow down but will not stop. The fact that the slow-down in the industry does not affect adversely neither the commerce or service, nor the agriculture or construction industry, is a very interesting phenomenon. In the light of the foregoing, the overall economic environment is still favourable but will slow down, although will affect the construction industry to a lesser degree.

![]() How long might the favourable boom in the construction take?

How long might the favourable boom in the construction take?

Based on our observations, the heat insulation industry will be very good until the end of 2021, but the overall construction industry will maintain its momentum in the following two years. Many of our projects is materialising in a slower period than we expected because of the chronic shortage of manufacturers and specialists. If we take a look at the building of new flats, the ongoing constructions will finish with a 5-percent VAT rate and, according to our expectations, will have been completed in 2020 or 2021. To that extent, the slow-down that could be perceptible in the issuing of new construction permits or the ongoing projects, will not influence the demand of construction materials in the upcoming years. Generally, the construction industry in Hungary and in this region is continually moving towards the renovation as we do not talk about problems in the numbers but issues in the quality and the distribution of flats. The constructions of new flats are concentrated in the economic-social centres, i.e. in the line of Győr, Székesfehérvár, Budapest, Pest county, Kecskemét and Debrecen. These regions will keep producing stronger data on the new homes construction, while the remaining parts of the country is expected to be weakened. The trends are similar in the Central Eastern Europe as there is no growth in the population or chronic housing shortage, but the demand is huge for the urban, convenient and modern flats to those studying in the higher education or moving to the city. A strong trend on the new flats construction can be observed, but it is true that the renovation will be more important in the upcoming years throughout the whole of Europe.

Dávid Tibor; Photo: Tamás Leskó

![]() The labour shortage is chronic in the construction industry. According to your experience, how difficult it is to maintain the labour force or find a new one?

The labour shortage is chronic in the construction industry. According to your experience, how difficult it is to maintain the labour force or find a new one?

With the slow-down of the boom, the indicators of confidence and expectations are on a downward path in the construction industry, the automation is spreading, therefore the recruitment and investment climate is decreasing among these industrial companies. So we have found that the pressure on the labour market has been eased compared to first semester. The availability of trained workforce is still scarce, the labour shortage is extremely significant in the construction industry and in the manufacturing sector. As the number of newly qualified constructional specialist is very low, a few sheathers, bricklayers and carpenters finish school. Unfortunately, these professions are still not appealing, although an entrant construction specialist can earn more than many young people with a degree. Therefore, the sector has no other chance than working with high-quality, easily and quickly applicable construction materials, namely increasing the productivity. We can fulfil the key positions on the important markets in the labour market, although we had no huge increase of staff in Hungary in the recent times. In Central Eastern Europe the situation is similar to the Hungarian, in Romania, Slovakia, Poland and Ukraine we struggle to hire new colleagues of an adequate number and level of professionalism. The conditions have gone among we could easily expand in Serbia or Vojvodina. In the last one year we have hired nearly 200 workers in Subotica and hiring the last 100 people was a challenge.

![]() Who should be responsible for the trainings? Is a public or private challenge?

Who should be responsible for the trainings? Is a public or private challenge?

The training has a public side, the state is also trying to draw attention of young people to the field where we operate, and the participating companies and manufacturers also have got their roles. We also collaborate with secondary and higher education institutions, we give presentations and trainings. The construction industry is rapidly developing, it uses modern tools and materials what should be transmitted to young people. Despite of these, we have no influence on their career choices, and only a few of this generation see their future in the physical work as a bricklayer or sheather.

![]() In your latest light report, you complained about the adverse effects of humid May and boiling June on the construction investments. Have Masterplast experienced the consequences of climate change as well?

In your latest light report, you complained about the adverse effects of humid May and boiling June on the construction investments. Have Masterplast experienced the consequences of climate change as well?

Our seasonality has remarkably changed. The trends, when winter used to be a dead period and summer brought above-average turnover and almost reached the peak in autumn, have completely changed. We studied its causes and talked with other directors. I would approach climate change from two standpoints: on one hand, the timing of constructions has changed. There are no harsh winters, so February is already an active period, and December, until the closing at Christmas, is also a very strong month. Only January is weaker a bit, but it also depends on the weather – if there are no frosts and the climate is mild, it also works well. Summer has become a dead period for two reasons: the workers are overwhelmed from the beginning of the year, they work at weekends as well and in summer they go on a holiday, have some rest. Moreover, the heat is so immense that it is impossible the perform certain works. According to our expectations, November can be stronger than August. Our peak period, that used to be August, September and October, now means the period from September to November. The climate change has another extremely important effect on the company and construction industry. We see that the heat insulation is strengthening because of 3 reasons. Firstly, the regulating authorities of the EU and Hungary would not like to procrastinate the implementation of energy regulation anymore. From 1 January 2020 a new construction permit of A+ category can only be issued if the constructed house will be insulated extremely well. Secondly, people have realised that the heat insular system not just protects against the heat, but the cold. As a result, we can not only save with the heating costs but with the electricity bill of the air conditioning in a well-insulated house as well. Winters are less frosty, but the summers are boiling, therefore the insulation has become extremely important. Thirdly, people have become more and more eco-friendly, they would like to fight against climate change and reduce their energy consumption. As a result, the production of heat insular systems is in a very favourable position. Despite of the slow-down of brick, tile or mortar usage, we have experienced a phenomenon: an average insulation thickness has already exceeded 12 cm and, according to our opinion, it will augment with 50 percent in the upcoming five years. People already tend to believe that facade plates with the thickness of 20 cm are needed, they avoid the basic white polystyrene and choose higher heat insulator graphite-containing products. As a result of the increased thickness, we expect a market expansion of 50 percent with the same surface in the following years which is a huge rise.

![]() Masterplast acquired a share in a polystyrene manufacturing company. What do you expect from the T-Cell collaboration?

Masterplast acquired a share in a polystyrene manufacturing company. What do you expect from the T-Cell collaboration?

For us this collaboration means that our manufacturing background has expanded, and with the capacity of T-Cell we could double the amount of polystyrene we sell within one year. Therefore, we have become one of the top 3 operators in the Hungarian market and our plants in Subotica, Zalaegerszeg an Hajdúszoboszló located in an optimal way from what we can supply our partners without a necessary delivery throughout the whole country. Besides the expansion of our manufacturing background, it enables us to strengthen our position on the polystyrene market and opens up new opportunities for sales. Through the acquisition, we have already established new contacts with buyers and further strengthened our positions in front of our big partners with national coverage.

![]() When can you measure the positive effects of the collaboration?

When can you measure the positive effects of the collaboration?

The effects of this acquisition is not calculated in our mid-term plans, it will be a surplus. The minor signs of T-Cell acquisition will be measurable in the second part of the year, when in November we show our new strategical numbers, they will be corrected considering those.

![]() How do you see the evolution of production in the plants of Subotica and Kál during the upcoming period?

How do you see the evolution of production in the plants of Subotica and Kál during the upcoming period?

The technological installation of the new engines in the plant of Kál covered a longer period than we planned. In the first six months it affected us rather negatively, the new engine could not produce relevant amounts, but the expanded manpower imposed labour costs and the test run meant material costs. At this stage, the technology is stable and its positive effects could be measured from the second semester. From the beginning of the next year, we count with bigger production and more effective manufacture in the plant. Subotica has already contributed to the results of the Group, and the numbers of production are continually improving. The effect of glass fibre is significant, but based on our calculations, it will be more immense in 2020. Compared to the production concluded in 80 million of 80 million square meters this year, the production will be available in 100 million square meters in the next year, with similar labour force and central cost level. This means a 25-percent growth and according to our hopes, its rise in the set of results will be even more remarkable. The first month when we produced with our full capacity was September, but we can operate with this production during the next year. So we are optimists, and the good news is that the demand for fibre glass is continually growing. Currently, we sell all our produced amount in advanced reservation and we had to overcome the challenge that we must operate with allocation until the end of this year with our partner and had to restrict the import of new customers. This will change in the next year.

Masterplast plant in Subotica; Photo: Masterplast

![]() Masterplast has recently sold its Austrian subsidiary and closed its Moldavian subsidiary. Do you plan further transformation in the regional operation?

Masterplast has recently sold its Austrian subsidiary and closed its Moldavian subsidiary. Do you plan further transformation in the regional operation?

An important goal of the last year and the first semester was to close all the non-working or dysfunctional areas. Some of them must have been closed because of technical reasons, for example the Moldavian operation had been inactive for years, but we wanted to leave behind all the burdens from the past. During the next strategic period we count with all those eight countries where we operate a subsidiary. A new entering will be justifiable if we could establish a strategic partnership or we have an opportunity to acquisition. The focus of our expansion is Europe, and we mainly observe opportunities in Western Europe.

![]() Masterplast was listed as B+ by Scope Ratings which fulfils the requirements of the participation of the Growth Debenture Programme. How do you assess this ranking?

Masterplast was listed as B+ by Scope Ratings which fulfils the requirements of the participation of the Growth Debenture Programme. How do you assess this ranking?

This listing is a necessary condition to change the financing structure of Masterplast through the bond program, to reduce the financing costs and hold a long-term source on a favourable price and conditions. We are happy that we have fulfilled this requirement but according to us, the Scope was very conservative. Their arguments were that we are a big construction materials manufacturer exposed to the industry and our main market is Central Eastern Europe. We do not entirely share their opinion about that we are not sufficiently diversified as, I think, we are interested in more fields and products than the other manufacturers, although it is true that construction industry means the top priority for us. According to their feedback, our current numbers are fundamentally good but they discounted our future prospects compared to our strategic plans. I hope that we could prove this cautiousness wrong. The main point is that we have a starting rating which corresponds to our goals and it is a way much more positive message if Scope sees one year later that we achieve the planned numbers and if we do so, we move up.

![]() Masterplast might issue bonds even in the amount of 6 billion Forints in the framework of Growth Debenture Programme. On what depends the volume? What does the company expend the resources accruing from this project?

Masterplast might issue bonds even in the amount of 6 billion Forints in the framework of Growth Debenture Programme. On what depends the volume? What does the company expend the resources accruing from this project?

Basically, we would like to be more cautious and we did not want our indebted measure to be too high, this is why we targeted a bonds issue in HUF 6 billion and we would like to draw the maximal amount. Having regard to the consumption, we will observe the possibility of restructuring the finance and creating a more favourable criteria system both in costs and in period. Another important aspect of the borrowing operations was to create freedom to the upcoming investments which so far are not in a phase to enter into the materials sent to Scope. Although we saw that the demand and interest is huge around the GDP, we did not want to wait months to concretise our plans.

Dávid Tibor; Photo: Tamás Leskó

![]() Under what interest rate might Masterplast issue bonds?

Under what interest rate might Masterplast issue bonds?

According to our current forecasts, the overall costs of the construction will be below the financing costs of our current bank credits. Raiffeisen is our counsellor in the bonding issue, with the bonds we partly redeem our credits at Raiffeisen. The bonding issue is important for the bank as well because we mainly expect banking customers to our corporate bonds.

![]() Scope expects stable margins at Masterplast, while the management communicates continual efficiency and improvement in the profitability.

Scope expects stable margins at Masterplast, while the management communicates continual efficiency and improvement in the profitability.

Ebben nem értünk egyet a Scope megállapításaival. Ők az iparág miatt is nagyon óvatosak voltak, miközben a szektor köszöni szépen, jól van. Ha a jövőben gyengébben teljesítene, akkor is tudnak nőni a marzsaink, mivel nő a kibocsátásunk és a gyártási hatékonyságunk.

![]() The credit ranking agency talks about a price war in its analysis what could be started by the biggest operators of industry and what could result in the declining turnover and market share of Masterplast.

The credit ranking agency talks about a price war in its analysis what could be started by the biggest operators of industry and what could result in the declining turnover and market share of Masterplast.

Generally, if the construction industry shrank, only the big manufacturers would survive. Although, we shall not forget that Masterplast is one of the leading operators of the grass fibre segment in Europe. If we produced brick and they compared us the Wienerberger, the statement would be valid about our vulnerability, but Masterplast is among the biggest operators in the glass fibre and polystyrene market.

![]() And can Masterplast as a big operator start a price war like this?

And can Masterplast as a big operator start a price war like this?

So far we have not experienced any kind of narrowing in the construction industry what brought a harsh price war after the previous crises in 2009-2010 to what many manufacturers responded by trying to maintain their volume on the decreasing market and increase their slice. We continue to count with a growing market until the end of 2021. We consider it as an option as with an aggressive price policy we could crowd out the smaller operators. Although, we do not prepare for this scenario as the glass fibre market is growing on a European level despite the slow-down of the volume of construction industry, the net-strengthening is becoming more and more widespread. It is not only used at facade heat insular systems but with a broadening application many aspects of building to strengthen the surface. The application of these products have been broadening so rapidly that I do not worry about a declining market neither here nor at the polystyrene. Another good news is that the important prospects of product are better in a shrinking construction industry than the general constructing materials.

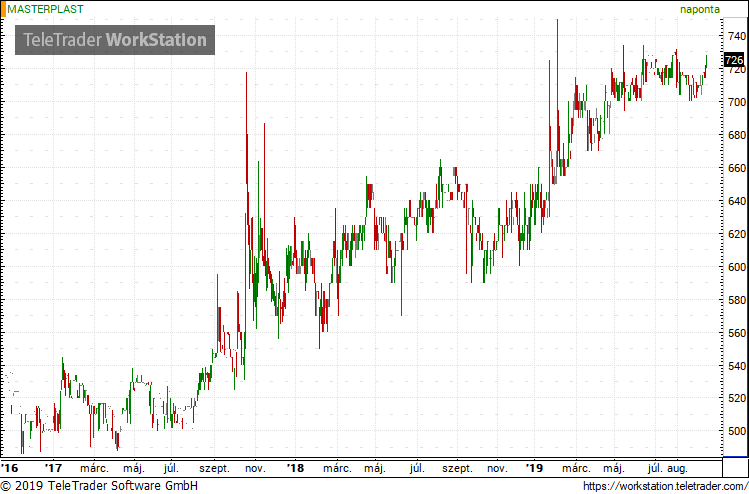

![]() The exchange rate of Masterplast has increased 11 percent this year, while BUX just 3. What do you think may be the reason for that?

The exchange rate of Masterplast has increased 11 percent this year, while BUX just 3. What do you think may be the reason for that?

In my opinion, the operators started to price the positive effects of the economic boom in case of Masterplast, what can be measured from quarter to quarter. On the other hand, this company achieves a level what assures that by 2021 it will have been producing more than half of its own products what leads to an extremely positive effect on efficiency. In addition, the investors understand and see that the prospects of the company are good, independently from the economic boom or downturn of the Hungarian construction industry. Personally, I am not satisfied with this increase in the exchange rate. I believe that further reserve can be found here and we will provide strong numbers from quarters to quarters. We can exploit the remaining reserves in the exchange rate with the dividends plan, the visionary growing dynamics. We have already got through the big announcements, the launch of investments, mid-term strategy and the increasing dividends path.

![]() What could be the next trigger? If you had to convince the investors about Masterplast now, what would you tell them, what is the story?

What could be the next trigger? If you had to convince the investors about Masterplast now, what would you tell them, what is the story?

I would outline two things. One of these is our continuous development as manufacturers what results in the permanent profitability of the company and this development makes us a little bit independent from the industrial effects. We could maintain our marge level even in a decreasing construction environment, but rather increase it by becoming more and more significant operators. On the other hand, we are present in segments of the construction industry which takes place separately. Thanks to our good decisions in the past few years, the broadening of glass fibre application and the thickening of polystyrene freed us from the numbers of newly built houses. Independently of the momentary conditions of the construction industry, we own development factor and profit reserves. Masterplast has reached a level which ensures that practically we will have a better year than our peak period was in 2007-2008. I expect 2019 to be the best year in the history of the company. But this not the peak, the true story of Masterplast is that we have just achieved a level from what the development will be larger. We operate with a stable and relatively young team, in the key positions we apply colleagues in their forties who have been working in Masterplast for more than 10 years, our management is good and we are ready to think big both financially and professionally. We do not talk about an enclosing growing period but about a company who is strong enough to move up to the next level. For God’s sake, the foreign expansion is in our DNA as we have been operating in an international market since 2001. We have gained experience since the first big growing period of Masterplast, therefore we will be able to realise to second period with more knowledge and routine.

Masterplast Nyrt.

Founded in 1997, the Masterplast group is one of the leading building material producer and distributor companies in the Central Eastern European region. The company group owns subsidiaries in 10 countries, and sells products in a further 30 countries. The company is registered in the premium category on the Budapest Stock Exchange, and had revenue of 145,2 million euros in 2023.