The outbreak of the COVID-19 destroys the operating environment of the construction industry as well. According to the survey conducted by GKI and Masterplast, after tackling the crisis, the prospects of the renovation and modernization sector will definitely be more favorable than the housing construction. Due to the expected caution of the citizens, the demand for smaller renovations might increase, unlike buying a new flat needs larger investment.

GKI conducts a survey every month among the constructional companies. From January 2020, the survey has been conducted with the contribution of Masterplast Nyrt. During the survey, the answers of 200-250 enterprises, from what 40-50 deal with renovation and modernization, were processed.

The escalation caused by the coronavirus and the announcement of the national emergency situation created a hostile environment to the construction industry, including the renovation and modernization sector. However, the first quarter went well, even a sort of stocking and acquisition could be experienced. One of the motives for this is that the manufacturers would like to work in all circumstances, secondly, a substantial part of those stays-at-home because of must would choose a ‘DIY-type’ of renovation. The prognosis of the government and the national bank still count with a possible upswing this year; however, the Minister of Finance would welcome a slight increase gladly which indicates a possible recession. The question is not the trend itself, but the level of the recession, according to GKI. In case the restrictive measures will have been stopped by the end of the second half year, and the economy returns to normal in the third quarter, then we could overcome the current crisis with an approx. 3-percent economical decline. That would cause a 1-percent drop in the consumption and an 8-percent fall in the investment yearly. The possible excessive length of the virus might cause a more immense, approx. 7-percent drop (besides 4 percent in the consumption and 10 percent in the investment).

The difficulties of the renovation and modernization have to face with hardly differ from the problems rule the overall construction industry. Based on the survey of March, almost 60 percent of the companies suffer from labor shortage, which restrictive effect might decrease due to the consequences of the virus (or the restrictive measurements will be determining temporarily). Every third company considers the current tax burden to be high, in addition, every fourth suffers from unfair competition (in the construction industry ‘only’ every fifth). Only 8 percent of the renovating and modernizing companies consider the delayed payments serious issue, while it is a problem for every fifth company in the construction industry.

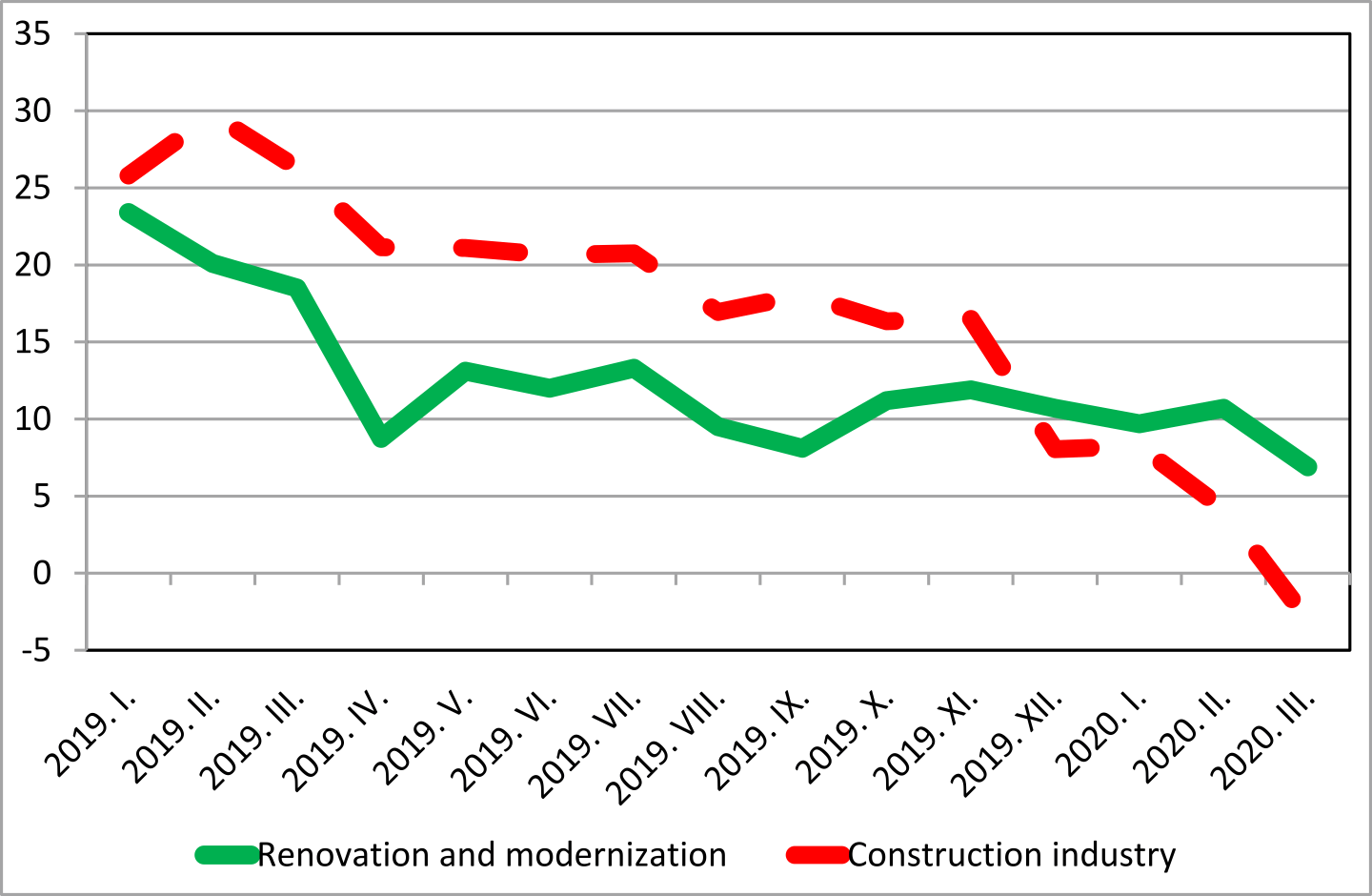

Confidence indicators in the construction industry as well as in the field of renovation and modernization, 2019-2020

Source: GKI surveys

During the first half of March, 22 percent of the companies planned to increase the number of staff, and none of these expected a downsizing – giving a good indication of the immense role of the labor shortage. During the epidemic, it appears differently.

According to GKI surveys, the confidence indicators, i.e. the economic prospects are continuing to deteriorate. The expectations of the renovating and modernizing companies are also in decline, but the stagnation was the significant trend last year. This strongly suggest that if the construction market wakes up from the ‘hibernation’, an upswing can be measured in the renovation and modernization market. The growth of this segment could be more favorable, especially because the termination of the preferential VAT-rates severely disrupted this field.

Masterplast Nyrt.

Founded in 1997, the Masterplast group is one of the leading building material producer and distributor companies in the Central Eastern European region. The company group owns subsidiaries in 10 countries, and sells products in a further 30 countries. The company is registered in the premium category on the Budapest Stock Exchange, and had revenue of 145,2 million euros in 2023.