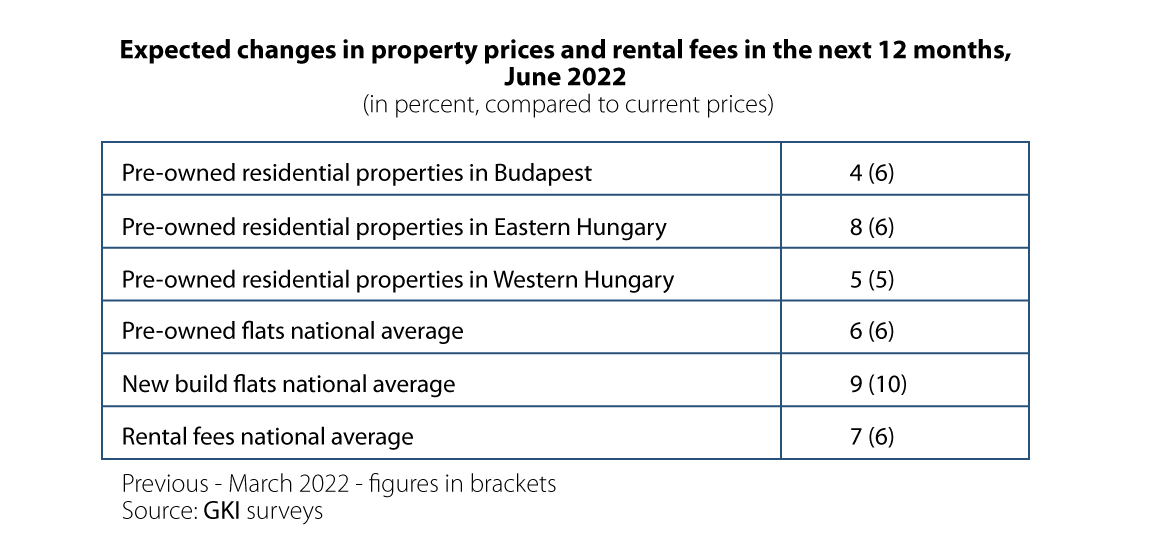

The national property market index has remained stagnant since the last survey, and the national index has increased by 2 points. Fewer real estate professionals are expecting a price increase: half of the survey participants in the capital city, whereas one-third of participants in the countryside said to be anticipating it. The price of used flats might increase by 6%, whereas newly built flats can cost 10% more in the next year, shows a joint survey conducted by the Hungarian Economic Research Co (GKI) and Masterplast.

GKI conducts a survey quarterly to identify real estate company prospects, and this survey was answered by 100 companies. The survey uses the results of a representative residential poll (based on a sample of 1000 participants). Since January 2020, the survey has been sponsored by Masterplast Nyrt.

Rising incomes, state subsidies (Family Housing Allowance (CSOK), Village CSOK, 5% VAT of new builds), and loans with favourable interest rates (Green Loan by the Hungarian National Bank, and the ‘baby expecting loan’) all have a boosting effect on demand in the property market. At the same time, market players need to face several risks as well. Besides the accelerating inflation (including the dynamically increasing construction costs) and increasing interests, uncertainty caused by the Russian-Ukrainian conflict is also present. The latter one is generally considered negative by 47% of real estate companies, and only 14% of them regard it to be positive (while 39% said that this conflict has no substantial effect).

The results of this survey convey that the property market over-demand will remain in each region for the next year. Among real estate companies in the capital city, prospects for the following 12 months have hardly changed compared to the previous quarter. Relevant improvement can only be seen in the market of properties in the green belt of Pest and flats in panel buildings in Buda. Eastern Hungary shows a mixed picture. Outlooks regarding flats in panel apartments have been slightly improving, by contrast, they have been worsening a bit as regards brick flats. In Western Hungary, detached house-related outlooks have somewhat bettered, but in other segments, no relevant changes can be observed.

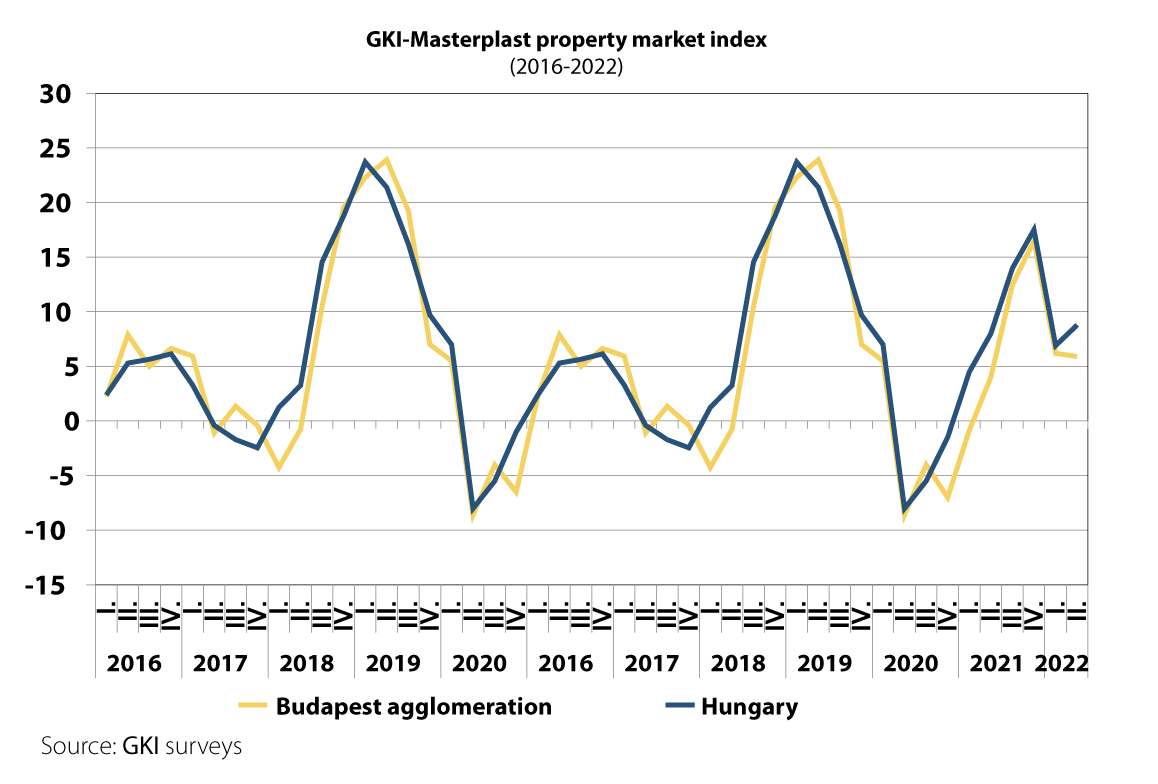

GKI and Masterplast’s property market index for the capital city, a figure comprising expectations of real estate companies and the public, basically has not changed in the last quarter, with a yearly increase of 2 points. The same index for the whole country shows a quarterly increase of 2 points and a yearly increase of 1 point.

Regarding used flats, in Budapest nearly, whereas in the countryside, more than half of the surveyed real estate companies are expecting a price increase. In Budapest and Western Hungary, a 4-5%, and in Eastern Hungary, an approximately 8% price increase is to be expected.

Two out of three survey participants are expecting a price increase in new builds, and nobody indicated the opposite. Prices here are pushed upwards not only by increasing construction costs but also by a limited supply. Shortly, this segment might face a 10% price increase.

As regards the rental property market, two third of the participants are expecting rising rental fees, whereas only a few of them indicated a reduction. In the following year, an about 7% increase in fees is likely to happen.

Masterplast Nyrt.

Founded in 1997, the Masterplast group is one of the leading building material producer and distributor companies in the Central Eastern European region. The company group owns subsidiaries in 10 countries, and sells products in a further 30 countries. The company is registered in the premium category on the Budapest Stock Exchange, and had revenue of 145,2 million euros in 2023.