The national housing market index has decreased by 9 points, while the capital index has decreased by 10 points since the last survey. More real estate professionals are anticipating a fall in prices. In the capital, no or slight decrease and more observable moderation is expected in the countryside, shows a joint survey conducted by the Hungarian Economic Research Co (GKI) and Masterplast.

GKI conducts a quarterly survey to identify real estate company prospects, and 91 companies answered this survey. The survey uses the results of a representative residential poll (based on a sample of 1000 participants). Since January 2020, the survey has been sponsored by Masterplast Nyrt.

Among real estate companies in the capital city, prospects for the following 12 months have significantly declined compared to the previous quarter. In almost all segments, supply exceeds demand to a greater or lesser extent; overall, an oversupply is probable. Demand and supply balance is only expected in the market of flats in panel buildings in Buda; however, prospects have declined in this area as well since the previous quarterly survey. In Eastern and Western Hungary, prospects have also deteriorated, and oversupply is expected in all segments.

Residents are more cautious than they were before. The number of households with a definite intention to buy or build decreased by 17% and likely of buying or building decreased by 13% compared to the last survey.

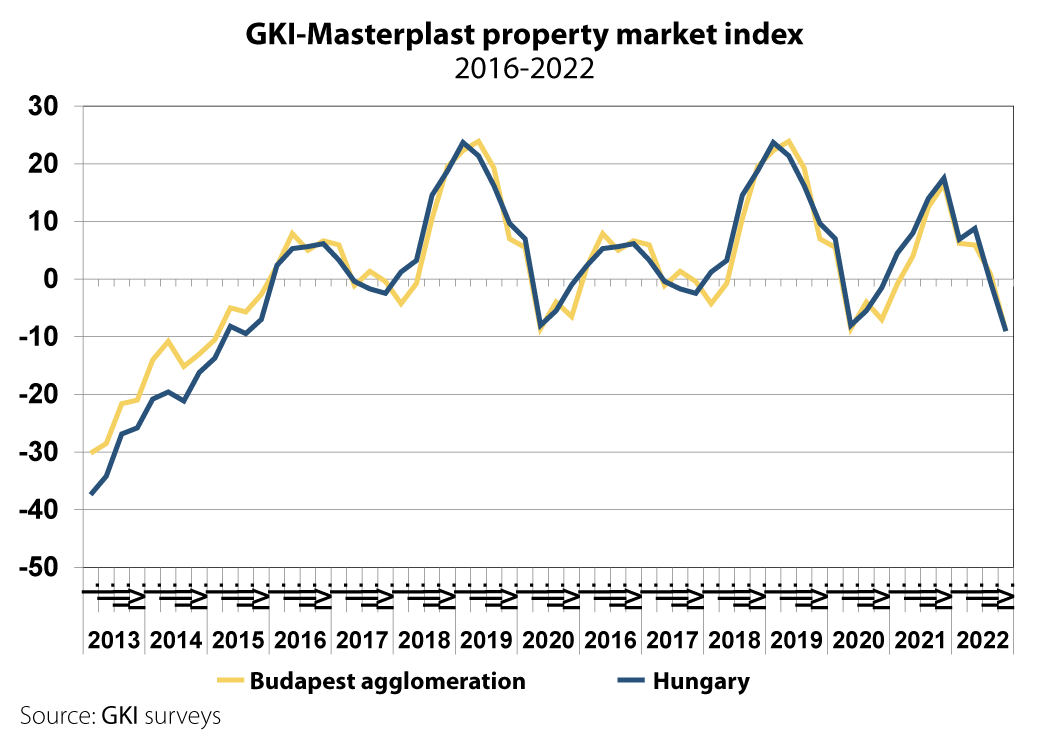

Housing market indexes have been continuously decreasing in 2022, meaning market outlooks are failing. GKI and Masterplast’s property market index for the capital city, a figure comprising expectations of real estate companies and the public, has decreased by 10 points in the last quarter and yearly by 26 points. The same index for the whole country shows a quarterly decrease of 9 points and a yearly drop of 27 points. These index figures are similar to the statistics measured at the lowest point of the pandemic.

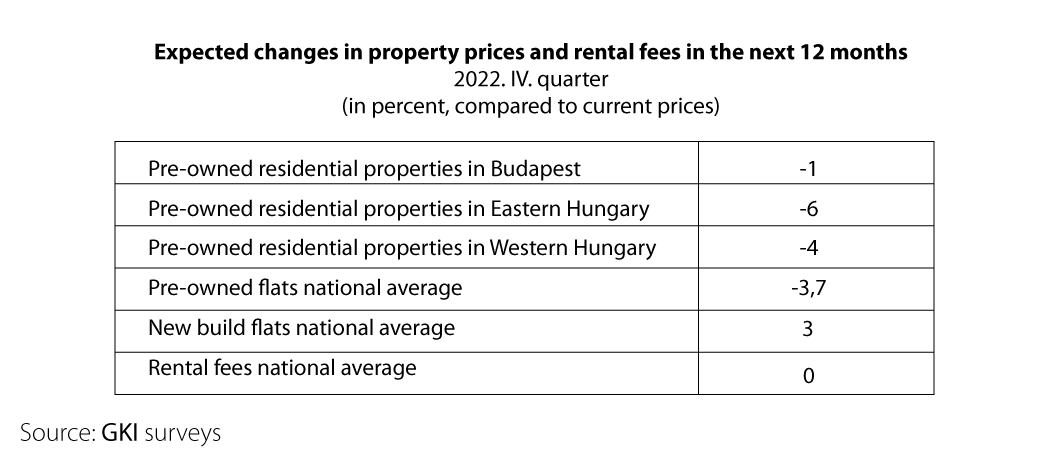

Regarding the prices of pre-owned flats, according to this survey, 19% expect an increase, 48% stagnation, and 33% decrease in prices. The cumulative numerical prognosis is symbolic, showing a 1% price fall. Panel flats will probably keep their value. In the countryside, the majority expect a price fall – the cumulative prognosis in the West suggests 4% while in the East, 6% price decrease.

One out of three survey participants expect a price increase in new builds, and almost two-thirds expect stagnation. In Budapest, 45% (more than average) expect further price rises. Respondents expect an average 3% price increase in the next year and a 5% in the capital.

As regards the rental property market, a tendency for the price increase was notable. Outlook for the near term showing differentiated picture based on regions: expected price increase is 4% in the capital and 2% in the Western region, while a 6% decrease is probable in the Eastern region.

Masterplast Nyrt.

Founded in 1997, the Masterplast group is one of the leading building material producer and distributor companies in the Central Eastern European region. The company group owns subsidiaries in 10 countries, and sells products in a further 30 countries. The company is registered in the premium category on the Budapest Stock Exchange, and had revenue of 145,2 million euros in 2023.